All Categories

Featured

Table of Contents

Premiums are usually reduced than entire life policies. With a degree term plan, you can choose your protection amount and the plan length. You're not locked right into an agreement for the rest of your life. Throughout your plan, you never ever have to fret about the premium or survivor benefit quantities altering.

And you can't cash out your plan during its term, so you will not obtain any type of financial take advantage of your past protection. As with various other kinds of life insurance, the cost of a level term policy relies on your age, coverage demands, work, way of living and wellness. Typically, you'll discover extra inexpensive coverage if you're younger, healthier and less dangerous to insure.

Considering that level term costs remain the very same for the period of insurance coverage, you'll know specifically how much you'll pay each time. Degree term coverage also has some flexibility, allowing you to customize your policy with extra features.

You might have to satisfy specific problems and qualifications for your insurance firm to enact this rider. There also might be an age or time restriction on the insurance coverage.

What are the benefits of Low Cost Level Term Life Insurance?

The survivor benefit is generally smaller, and protection typically lasts until your kid transforms 18 or 25. This biker might be an extra cost-efficient method to aid ensure your children are covered as cyclists can typically cover multiple dependents at the same time. Once your youngster ages out of this insurance coverage, it might be feasible to transform the cyclist right into a brand-new policy.

The most common type of long-term life insurance coverage is whole life insurance policy, however it has some key distinctions compared to level term insurance coverage. Below's a basic introduction of what to take into consideration when comparing term vs.

Whole life entire lasts insurance policy life, while term coverage lasts protection a specific periodCertain The premiums for term life insurance coverage are usually lower than whole life insurance coverage.

Why should I have Level Term Life Insurance?

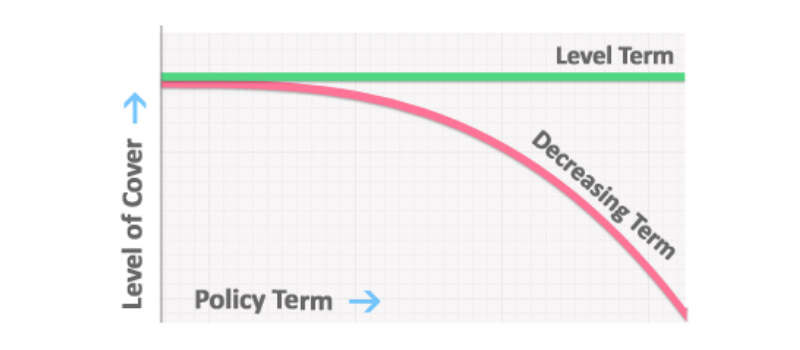

One of the primary features of degree term coverage is that your premiums and your survivor benefit do not change. With lowering term life insurance coverage, your premiums remain the exact same; nonetheless, the survivor benefit amount gets smaller gradually. For instance, you may have insurance coverage that starts with a fatality benefit of $10,000, which can cover a mortgage, and after that every year, the fatality benefit will lower by a set amount or percent.

Due to this, it's usually a more cost effective kind of level term protection., however it might not be sufficient life insurance for your needs.

After choosing a policy, complete the application. For the underwriting procedure, you may have to provide basic individual, wellness, way of living and work info. Your insurer will certainly determine if you are insurable and the danger you might present to them, which is reflected in your premium expenses. If you're accepted, authorize the paperwork and pay your initial costs.

Ultimately, think about organizing time each year to assess your plan. You may want to update your recipient information if you've had any type of significant life modifications, such as a marriage, birth or separation. Life insurance can sometimes feel difficult. However you do not need to go it alone. As you explore your options, take into consideration reviewing your requirements, desires and worries about an economic professional.

Affordable Level Term Life Insurance

No, level term life insurance policy does not have cash money worth. Some life insurance policy plans have a financial investment feature that allows you to build cash money value over time. Level term life insurance vs whole life. A section of your premium settlements is alloted and can gain passion over time, which grows tax-deferred throughout the life of your insurance coverage

These plans are often significantly more expensive than term protection. If you reach completion of your policy and are still to life, the coverage finishes. However, you have some choices if you still want some life insurance coverage. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might intend to buy a new 10-year degree term life insurance policy policy.

Who offers flexible Level Premium Term Life Insurance plans?

You may be able to transform your term protection into an entire life policy that will certainly last for the remainder of your life. Many kinds of degree term plans are convertible. That implies, at the end of your protection, you can convert some or every one of your plan to entire life coverage.

Degree term life insurance coverage is a policy that lasts a collection term usually in between 10 and three decades and includes a degree survivor benefit and level costs that stay the same for the whole time the policy is in impact. This indicates you'll know exactly how much your payments are and when you'll need to make them, enabling you to budget plan accordingly.

Level term can be a terrific option if you're wanting to get life insurance policy protection for the first time. According to LIMRA's 2023 Insurance Measure Research Study, 30% of all adults in the united state need life insurance policy and do not have any kind of kind of policy yet. Degree term life is predictable and affordable, which makes it among the most popular kinds of life insurance policy

A 30-year-old man with a similar account can expect to pay $29 per month for the exact same coverage. AgeGender$250,000 protection quantity$500,000 insurance coverage amount$1 million coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Ordinary monthly prices are calculated for male and female non-smokers in a Preferred health and wellness classification acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy policy.

Where can I find Fixed Rate Term Life Insurance?

Rates might vary by insurance company, term, protection quantity, wellness class, and state. Not all plans are readily available in all states. It's the most inexpensive type of life insurance for most individuals.

It allows you to budget plan and plan for the future. You can quickly factor your life insurance policy into your budget because the premiums never change. You can prepare for the future equally as easily due to the fact that you recognize exactly how much money your liked ones will obtain in case of your absence.

What does a basic Level Term Life Insurance For Young Adults plan include?

This is real for people that gave up smoking cigarettes or who have a health condition that settles. In these instances, you'll generally need to go with a new application procedure to obtain a better rate. If you still need coverage by the time your level term life policy nears the expiration date, you have a couple of options.

Table of Contents

Latest Posts

What is Simplified Term Life Insurance? A Simple Explanation?

What is the difference between Level Term Life Insurance Coverage and other options?

What is the most popular Low Cost Level Term Life Insurance plan in 2024?

More

Latest Posts

What is Simplified Term Life Insurance? A Simple Explanation?

What is the difference between Level Term Life Insurance Coverage and other options?

What is the most popular Low Cost Level Term Life Insurance plan in 2024?