All Categories

Featured

Table of Contents

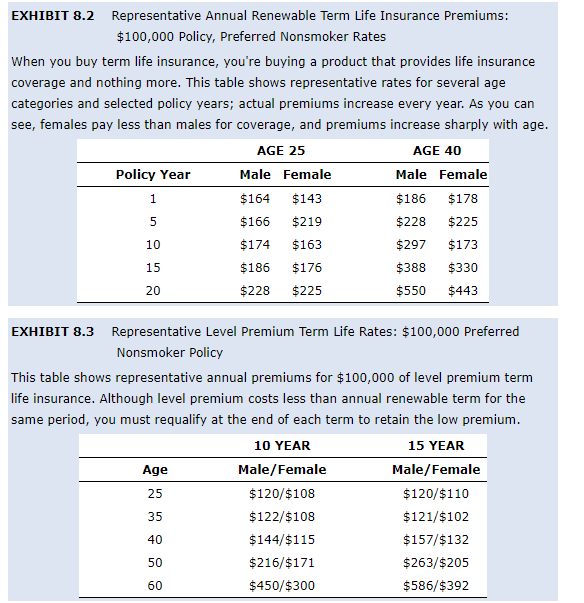

A level term life insurance policy plan can provide you satisfaction that the people that depend on you will certainly have a survivor benefit throughout the years that you are preparing to sustain them. It's a method to help deal with them in the future, today. A level term life insurance policy (in some cases called degree costs term life insurance policy) policy gives coverage for an established variety of years (e.g., 10 or two decades) while keeping the premium repayments the exact same throughout of the plan.

With level term insurance coverage, the price of the insurance will certainly stay the very same (or possibly decrease if dividends are paid) over the regard to your plan, usually 10 or 20 years. Unlike permanent life insurance coverage, which never ever ends as lengthy as you pay costs, a level term life insurance policy policy will finish at some time in the future, generally at the end of the period of your level term.

What is 10-year Level Term Life Insurance? Explained in Simple Terms?

Due to this, lots of people make use of irreversible insurance policy as a steady financial planning tool that can offer several needs. You might be able to transform some, or all, of your term insurance coverage during a collection period, commonly the first one decade of your plan, without needing to re-qualify for coverage even if your health has actually transformed.

As it does, you might desire to contribute to your insurance protection in the future. When you initially obtain insurance, you might have little savings and a huge home loan. Eventually, your financial savings will grow and your mortgage will shrink. As this occurs, you may wish to ultimately lower your death benefit or take into consideration transforming your term insurance to a long-term plan.

Long as you pay your premiums, you can relax simple knowing that your loved ones will certainly receive a fatality benefit if you pass away throughout the term. Lots of term plans permit you the capability to convert to long-term insurance policy without needing to take one more health test. This can permit you to capitalize on the fringe benefits of a long-term policy.

Degree term life insurance policy is just one of the easiest courses into life insurance policy, we'll talk about the advantages and disadvantages to ensure that you can pick a plan to fit your needs. Degree term life insurance policy is one of the most common and basic type of term life. When you're searching for short-lived life insurance policy strategies, degree term life insurance policy is one path that you can go.

The application process for level term life insurance policy is commonly really uncomplicated. You'll complete an application that has general individual information such as your name, age, etc in addition to an extra detailed set of questions concerning your case history. Depending upon the policy you want, you may need to take part in a clinical examination procedure.

The short solution is no., for instance, allow you have the convenience of death advantages and can accumulate cash value over time, suggesting you'll have much more control over your advantages while you're to life.

What is What Is Level Term Life Insurance? Key Information for Policyholders

Motorcyclists are optional arrangements included to your policy that can give you added advantages and protections. Anything can take place over the training course of your life insurance policy term, and you desire to be all set for anything.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

This biker provides term life insurance policy on your youngsters through the ages of 18-25. There are instances where these benefits are constructed into your plan, yet they can additionally be readily available as a different enhancement that calls for additional settlement. This biker offers an additional fatality benefit to your recipient should you die as the result of a crash.

Latest Posts

Burial Insurance For Over 80

Seniors Funeral Insurance Phone Number

What Is The Best Funeral Insurance