All Categories

Featured

Table of Contents

- – What Is Level Term Life Insurance?

- – Who offers Level Term Life Insurance Quotes?

- – Best Level Term Life Insurance

- – What is included in 20-year Level Term Life I...

- – What does Best Value Level Term Life Insuran...

- – Is there a budget-friendly Affordable Level ...

- – Why should I have Affordable Level Term Life...

The primary differences between a term life insurance policy plan and an irreversible insurance coverage (such as whole life or universal life insurance policy) are the period of the policy, the build-up of a cash value, and the expense. The appropriate selection for you will certainly rely on your needs. Here are some points to take into consideration.

People who possess entire life insurance policy pay much more in premiums for less insurance coverage however have the safety of knowing they are safeguarded for life. Level premium term life insurance. Individuals that buy term life pay costs for an extensive duration, however they obtain nothing in return unless they have the misfortune to pass away before the term expires

The efficiency of irreversible insurance coverage can be constant and it is tax-advantaged, providing additional advantages when the stock market is unstable. There is no one-size-fits-all solution to the term versus irreversible insurance argument.

The rider guarantees the right to transform an in-force term policyor one regarding to expireto a permanent strategy without experiencing underwriting or verifying insurability. The conversion biker ought to permit you to transform to any type of long-term plan the insurance business supplies with no limitations. The primary features of the rider are keeping the original wellness score of the term policy upon conversion (also if you later have health and wellness problems or end up being uninsurable) and choosing when and exactly how much of the insurance coverage to transform.

What Is Level Term Life Insurance?

Of course, total premiums will enhance significantly given that entire life insurance policy is much more pricey than term life insurance coverage - Tax benefits of level term life insurance. Medical problems that develop throughout the term life duration can not create premiums to be boosted.

Term life insurance policy is a relatively economical means to supply a lump sum to your dependents if something happens to you. If you are young and healthy and balanced, and you sustain a family, it can be a great choice. Entire life insurance policy features substantially greater monthly premiums. It is implied to give coverage for as lengthy as you live.

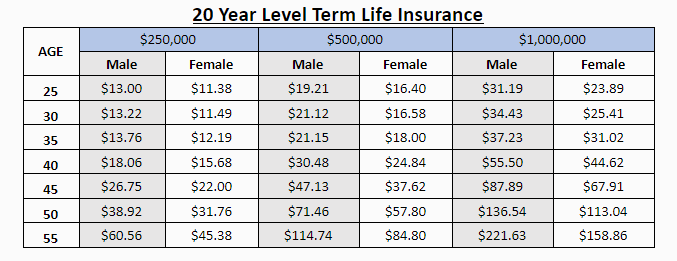

It relies on their age. Insurer established a maximum age limit for term life insurance policies. This is usually 80 to 90 years old, however might be greater or lower depending upon the business. The premium additionally rises with age, so an individual aged 60 or 70 will certainly pay considerably greater than somebody years more youthful.

Term life is somewhat similar to cars and truck insurance coverage. It's statistically unlikely that you'll require it, and the premiums are cash down the tubes if you don't. But if the most awful happens, your family members will obtain the advantages.

Who offers Level Term Life Insurance Quotes?

A level costs term life insurance policy plan lets you stay with your budget while you aid secure your family. Unlike some stepped rate strategies that boosts every year with your age, this sort of term plan provides prices that stay the very same for the period you select, even as you grow older or your health modifications.

Find out more concerning the Life insurance policy choices available to you as an AICPA participant. ___ Aon Insurance Policy Providers is the brand for the brokerage and program administration procedures of Affinity Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Policy Solutions Inc.; in CA, Aon Affinity Insurance Coverage Services, Inc.

Best Level Term Life Insurance

The Strategy Agent of the AICPA Insurance Policy Depend On, Aon Insurance Policy Services, is not affiliated with Prudential. Team Insurance protection is released by The Prudential Insurance Coverage Company of America, a Prudential Financial company, Newark, NJ. 1043476-00002-00.

Essentially, there are two kinds of life insurance policy intends - either term or permanent plans or some mix of both. Life insurance companies offer numerous types of term plans and typical life plans along with "passion delicate" products which have actually become much more widespread considering that the 1980's.

Term insurance policy offers security for a specified period of time - Term life insurance with fixed premiums. This duration can be as short as one year or give coverage for a certain variety of years such as 5, 10, two decades or to a specified age such as 80 or sometimes up to the earliest age in the life insurance coverage death tables

What is included in 20-year Level Term Life Insurance coverage?

Presently term insurance policy prices are very affordable and amongst the most affordable traditionally experienced. It should be kept in mind that it is a commonly held belief that term insurance policy is the least costly pure life insurance policy protection available. One needs to assess the plan terms carefully to choose which term life alternatives are ideal to meet your particular conditions.

With each new term the premium is raised. The right to renew the plan without proof of insurability is a crucial benefit to you. Or else, the threat you take is that your wellness might deteriorate and you might be unable to get a plan at the very same rates and even at all, leaving you and your beneficiaries without insurance coverage.

You must exercise this alternative throughout the conversion duration. The length of the conversion period will certainly differ relying on the type of term policy bought. If you transform within the proposed period, you are not called for to provide any info about your health and wellness. The premium price you pay on conversion is typically based upon your "present attained age", which is your age on the conversion day.

What does Best Value Level Term Life Insurance cover?

Under a degree term plan the face quantity of the policy remains the exact same for the entire period. With reducing term the face quantity decreases over the duration. The costs remains the very same yearly. Often such plans are offered as home mortgage protection with the quantity of insurance policy reducing as the balance of the mortgage lowers.

Commonly, insurance firms have not had the right to alter premiums after the policy is offered. Considering that such plans may proceed for years, insurance providers need to utilize traditional death, interest and cost rate quotes in the premium calculation. Adjustable costs insurance, nonetheless, allows insurers to use insurance policy at lower "existing" premiums based upon much less conventional assumptions with the right to alter these premiums in the future.

While term insurance coverage is made to offer security for a defined time period, permanent insurance policy is developed to offer coverage for your entire life time. To maintain the costs rate level, the premium at the younger ages exceeds the actual cost of defense. This added costs builds a reserve (cash value) which helps spend for the policy in later years as the cost of protection rises above the premium.

Is there a budget-friendly Affordable Level Term Life Insurance option?

With level term insurance, the price of the insurance coverage will remain the very same (or possibly decrease if rewards are paid) over the regard to your plan, normally 10 or 20 years. Unlike permanent life insurance policy, which never ends as lengthy as you pay costs, a level term life insurance policy will certainly finish at some point in the future, commonly at the end of the period of your degree term.

As a result of this, many individuals make use of permanent insurance as a stable economic preparation tool that can serve lots of requirements. You might have the ability to transform some, or all, of your term insurance throughout a collection duration, usually the very first ten years of your policy, without requiring to re-qualify for protection also if your wellness has actually altered.

Why should I have Affordable Level Term Life Insurance?

As it does, you may wish to contribute to your insurance policy protection in the future. When you initially obtain insurance policy, you might have little savings and a huge home mortgage. At some point, your cost savings will grow and your home loan will certainly reduce. As this happens, you might want to ultimately minimize your survivor benefit or think about converting your term insurance to a long-term policy.

So long as you pay your costs, you can rest simple knowing that your liked ones will certainly obtain a death benefit if you pass away during the term. Numerous term policies allow you the capability to transform to irreversible insurance without having to take one more wellness exam. This can enable you to benefit from the additional benefits of a permanent plan.

Table of Contents

- – What Is Level Term Life Insurance?

- – Who offers Level Term Life Insurance Quotes?

- – Best Level Term Life Insurance

- – What is included in 20-year Level Term Life I...

- – What does Best Value Level Term Life Insuran...

- – Is there a budget-friendly Affordable Level ...

- – Why should I have Affordable Level Term Life...

Latest Posts

Burial Insurance For Over 80

Seniors Funeral Insurance Phone Number

What Is The Best Funeral Insurance

More

Latest Posts

Burial Insurance For Over 80

Seniors Funeral Insurance Phone Number

What Is The Best Funeral Insurance